A while ago I read an article in the Guardian which states that in order to combat climate change we don’t just need to switch to renewable energy, we need to create a new economic system. I have been doing some research of monetary systems and the economic eco systems they create for a while and after reading the article some extra pieces of the puzzle clicked into place.

Capitalism, an economy of acquisition

Our current capitalistic economic system is one of acquisition. Its goal is to acquire capital in its many forms. Real estate, factories, patents, web companies, … and ultimately the one to rule them all: money. And all these assets are perceived to be scarce. If I want something I can’t allow you to have it too because there is not enough for the both of us. This creates unhealthy competition and a world where the ‘get as much profit as possible’ business model is king. If you can’t turn it into a business model that creates profit you’ll have a hard time getting it funded. And it doesn’t end there. You need to make more profit every year because otherwise your business will be branded as a failure. Grow, grow, grow! is the mantra of the day.

This mentality is costing lives, literally! Real, life saving projects like the one that wants to create cheap, paper based blood test devices to be used in developing countries get left in the dust because they are not profitable enough.

In a world where perceived scarcity runs the show and it’s all about collecting as much as possible, greed is the only outcome. And we all know how that pans out. It’s a destructive force that eats away at our naturally helpful nature. It even has a measurable effect on 3 year olds.

But it doesn’t have to be this way. We created this economic system, which means we can also change it.

The components of an economic system

An economic system, at its core, consists of goods and services that are traded. A monetary system is usually used to facilitate that trade.

Now I’m sure economists will say I am oversimplifying things and I’m sure they’re right if we want to talk about the full complexity of economic systems. But take away goods and services and you won’t have much of an economy left. The complexities of the economic system arise from the wants and needs that are associated with these goods and services, and the design of the monetary system if one is used.

An economy runs in a society. You need people to have economic activity, even if those people use computers and robots to perform that activity for them (think smart trading algorithms on Wall Street). Since it ultimately comes down to running a well functioning society through economic and other activities, we can look at which economic activity we need in order to have this well functioning society. In other words, which goods and services need to be passed around (traded) in order to keep everyone happy?

The primary goods are clean water, food and shelter. Without the first 2 we’d just die, without shelter life can get very harsh, depending on where you live.

There is no real shortage of either of these resources, yet we see people starve from hunger, die from a lack of clean water and then I’m not even mentioning the countless homeless people who are sleeping on the streets all over the world. Why? The answer is simple. Because those people don’t have enough access to money. If they had, it would open the doors to clean water, nutritious food and decent shelter. Now neo liberalists will claim these people just don’t work hard enough and if they would they’d be lifted out of poverty in no time. Nick Hanauer states it differently in his TED talk: luck is a major factor in your success.

And the money? That’s just an agreement on what we use to represent real value.

The non-flow of our current system

The one big problem our capitalist system has is that it inherently creates a money flow from the poor to the rich. This shows in the figures. In 2010, 388 people owned as much money as the 3.4 billion poorest. In 2016 that number changed to 8 people holding the same amount of wealth as the 3.6 billion poorest. Money just has a strong tendency to flow to the financial world. Once it gets there it just runs around in circles, adding no real value to our society. But it does increase the wealth of the wealthy. The entire financial world is actually a huge pile of money just sitting there, doing nothing but shifting place from one pocket to the next. Sure, a little bit, according to some estimates around 15%, trickles down to the rest of us again. But obviously not as much as is being sucked into it. Otherwise it would be hard to explain the numbers from this chart that gives an overview of all available money that exists in the world. Here’s a small excerpt of those numbers:

- $28.6 trillion: readily available money (coins, banknotes and money on accessible accounts)

- $70 trillion: value of the stock market

- $600 – $1200 trillion: value of the derivatives market

If trickle down economics would really be a boon for society then these numbers should be more in balance.

Why is this? The answer is fairly simple: hoarding money is rewarded with more money. Yes, this is a simplified statement but once you get your hands on your first couple of millions it becomes ever easier to increase that amount if you play the financial markets right. And when you have enough to spare you can spread your risks and make sure that there’s no real danger to losing it all.

But these people invest in business I hear you say. Yes, they do … if they can turn a profit from them. More often than not, a successful startup eventually turns into a money machine for just a few people. Take Uber for example. Who is getting rich you think? The drivers or the people at the top? Again, most of the money flows to … pools of money.

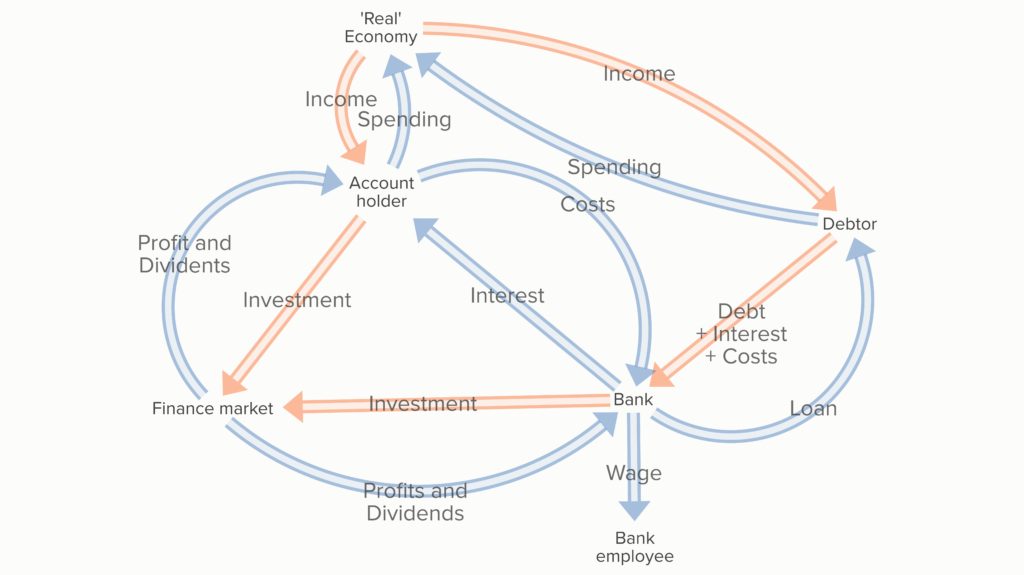

This is a mostly one directional flow, which is bad news if you’re on the wrong end of it. It looks like this:

Debtors and bank employees are also account holders but are displayed as separate entities to keep things clear.

The ‘real’ economy is the market of product and service providers which are not related to the financial market. Every member of this ‘real’ economy is also an account holder.

The money a debtor receives on her account is created by the bank, out of nothing. When the debt is payed back, this money is destroyed again together with the debt. The interest is profit for the bank. For a debtor, the income flow must be higher than the spending flow if she wants to be able to pay back the loan. That surplus on the income flow is at least partly used to pay for the interest on the loan and the bank costs. This process extracts money from the ‘real’ economy.

An account holder must make sure that the sum of his income, interest on his account and his profits and dividends are at least as high as his spending. Or become a debtor. If the income is high enough he can save some money for later. Once the sum that is saved reaches a certain volume the likelihood that it will be invested in the financial market rises due to the low to non existent interest that is gained on bank accounts these days. If interests were high, the money would just be kept in the bank, which also results of it ending up in the financial markets (see below). Once this happens most of the profits and dividends are probably reinvested in financial products, thereby keeping money in the financial markets. Also note that, if the income is largely received through the ‘real’ economy, part of that money now flows through to the financial markets.

Interests on loans, and profits and dividends from financial investments received by the bank which are not spent on wages and operating costs are also mainly reinvested in the financial markets. Banks also use a large part of your deposits for this purpose. This is possible because banks are not obligated to keep the total sum of all money on the accounts they manage available as reserve. This means that a lot of the money that people think is on their bank account is actually running around in the financial market.

As you can see, unless money is forced out of the financial markets, it has a strong tendency to flow towards Wall Street and consorts where most of it remains. This impoverishes the ‘real’ economy.

The model presented here is simplified but captures the core flows of our monetary system. It’s easy to see how the flows depicted by the orange arrows all contribute to helping money reach the financial markets. Once it reaches those, it tends to stay there. You could conclude that the financial markets are a dead end for monetary flows.

Creating real flow

Are there ways that would make sure money keeps flowing around in the ‘real’ economy and does not end up in an ever increasing stagnant pool which is just stirred around every now and then? For that we need to create the right incentives. As long as hoarding money pays off, hoarding will happen.

The town of Wörgl in Austria came up with a solution for this problem back in the 1930’s. It’s called a demurrage fee and it’s a tax on capital. It’s almost something like a negative interest. What it comes down to is this: if you want to hold onto your capital you’re gonna pay for it.

Now this may sound like strange idea, especially since we’ve been brought up with an interest bearing monetary system. But for Wörgl, it solved the economic crisis they were in. Since it discourages people to hold on to their money it automatically circulates. This vastly increases the chances that it comes back to you.

The creation of money needs to be changed too for this model to work of course. You can not create money from debt with an interest on it and then let it wither away through a demurrage fee. That would only make matters worse since interest would have to be paid from an ever shrinking pool of money. A demurrage fee would allow continuous creation of debtless money without creating out of control inflation though. Banks could be given an allowance for monthly monetary creation or it could be created for government spending on projects for the common interest or through a basic income. For this article it is assumed that it is created through a basic income because that adds some extra benefits to the economic eco system which will be explained below. How much that basic income should be is up for debate and outside the scope of this article. Let’s assume it gets created debt free and in large enough amounts to keep the economy going. What would be the impact of such a system?

The impact of real flow

Two things are bound to happen:

- People will start feeling really uncomfortable because old models of capitalisation all of a sudden become moot. What good is it to have a large capital in the bank which just melts away through a demurrage fee?

- The guaranteed basic income provides some security to counter that unease, at least for the average Joe.

Driving forces of a business

How can we deal with this change? What will business models look like?

Before digging into that question we need to look at what motivates people to set up a business in the first place. We can identify 2 non mutually exclusive driving forces: making money and following a passion. The first is simple and covers the range from making a decent living to wanting to become filthy rich. We could dive into the deeper psychological motifs that drive people to want to make lots of money but that’s beyond the scope of this article. The second driving force comes from within. It often clashes with the hard reality of our current system in which making money is an obligation for success. Unless you are rich already and have money to burn, which is usually not the case.

The new business game

If money is created through a basic income, setting up a business based on passion gets more leeway. People who want to work from this inner drive would then have more freedom to do so because they can tap into a guaranteed, never ending monetary stream which does not exist in our current system. Therefore businesses would not necessarily have to be profitable. They just need to be affordable for the people running them.

Those who want to make a profit will have to start playing a whole new game. Capital gain through profit is capped due to the demurrage fee, as the following simulation shows:

After a while the profit, calculated as revenue – expenses. balances out the demurrage fee paid on the reserve capital. This reserve capital fluctuates with the profit. If profit rises, so will reserve capital. If profit falls, so will reserve capital … even if the expenses remain the same.

Working with this kind of financial dynamic requires a whole new way of thinking about business models. Maybe some will claim it’s impossible to do business that way. Nothing is less true however. But people will behave differently when this model is released on them.

New possibilities

The first consequence of a demurrage fee is the fact that people will be more than happy to lend money interest free. Instead of losing money to a demurrage fee you can protect it from that fee by lending it out to someone else and create a new monthly income stream from it. Once people get used to working with monetary streams instead of capital even the habit of lending large sums might dissipate. That’s because passing around a large sum of money becomes comparable to passing around a hot potato. No one wants to hold on to it for long.

Now let’s look at possible changes in consumer habits and business models.

Saving for a rainy day

The amount of money we save for a rainy day changes in nature. Instead of a static pool which only changes when we either add extra money, earn some form of interest on it or retrieve money from when it’s needed, it now becomes a buffer which behaves like a dynamic equilibrium between our income and our expenses.

At first this might seem to be quite scary when we are stuck in the mindset of saving for when times get rough and our expenses supercede our income. We now create buffers for when we face big expenses or when our income drops from under our feet. But big expenses, which are the equivalent of big incomes for those on the receiving end are not really desirable for the ones receiving them unless they arrive at predictable intervals. Otherwise it is way more interesting to have the payment spread out over time in order to better manage monetary flows.

Also take into account that interest free loans have now become a possibility. Paying back these loans can always be backed by the guaranteed basic income, making access to new money easier. This basic income also functions as a replacement, at least at a psychological level, of our savings account. It would even provide more security than a savings account because a savings account can get depleted while a basic income just keeps coming.

There is a good chance that people will turn to physical assets as a way to ‘save’ for later. At least in the beginning. This has psychological reasons, namely that we are so used to needing some reserve that it could be hard to let go of that habit. This would increase the demand for these assets as an investment vehicle and could drive prices up. The downside of that would be that selling these assets would land the investor with a large sum of money which would have to be moved as fast as possible again. Where that would lead to exactly remains to be seen.

One thing is for sure though. As said before, since money keeps moving around the chances of it coming back to you are increased and those tough times might just be less tough to deal with.

It sure would take some getting used to but humanity excels at adapting to new situations and after a while people would probably wonder why it has ever been different.

Experiencing vs owning

Buying goods fits well with our current concept of capitalism. It’s an acquirement of something which is then held in possession. It’s static, just like the concept of capital. But as Thomas Rau points out in his presentation on the performance economy, we’re often not really interested in the product but in the services and experiences we get from it.

A car gives us a driving experience, a TV gives us a movie experience, a bed gives us a sleeping experience, … Right now we spend a large sum of money to then own something that gives us the experience we want. But in this new economy of flows, that one off large sum of money is not so desirable. Smaller sums of money that keep flowing into your business on a regular basis become way more interesting. We could all lease the experience we want without owning the product. As explained, this creates a business model that encourages producers to create long lasting, energy efficient products which are preferably repairable and recyclable. These producers in turn could pay for production experiences from their suppliers of tools and machinery. Thereby creating a sustainable production chain. In this model the products themselves remain in the possession of the manufacturers. Maintenance and operation costs in terms of energy and resource use also remain the responsibility of the manufacturer. The income streams are the monthly fees paid for the experience. The result of this is more predictability. Right now, when you market your product, your client has a one off transaction with your business when they buy it. You have no clue if or when they will do business with you again. They might keep the product for years if it lasts. Or they might buy a new one due to fashion changes or technological upgrades as soon as they come to market. RIght now a lot of business models run on planned obsolescence and then it’s hoping and praying that it works. A circular monetary system favors long term customer relationships which adds predictability to the financial situation of a company.

Consumers will manage their budget in a different way. Say I purchased a top notch movie watching experience costing me $150 a month. But then I change my lifestyle and become an active member of a sports club. I notice that I’m actually not using that movie watching experience that much anymore and I decide to downgrade it to a $25 experience for those occasions I still use it. Thereby freeing up some money for other experiences. The TV equipment is picked up by the provider of the service and replaced by something that matches my new fee. This set can now be installed somewhere else or recycled to be used in the production of a new generation of equipment. Reuse would get a huge boost and the cost in resources for the manufacturer would be minimal.

Another upside of these kinds of business models is that it might boost happiness of people. There is a possibility that consumers start thinking in terms of the experiences they want instead of stuff, which would alter their perception and shift their focus towards experiences. And research has shown that buying an experience makes people happier than buying stuff. That’s a win for both the business and the consumer.

A business model that runs on monetary streams and sells experiences would make planned obsolescence a thing of the past. Repairability, reuse, recyclability and upgradability would become the core values of a successful business. Imagine the impact this would have on our planet. That’s a triple win!

Down to the building blocks

Now take this line of thinking towards the manufacturers of raw resources: mines, farms, wood cutting companies, … The same kind of logic can not always be applied here. You can not remain the owner of a tomato you sold for example. Mining companies would probably have a hard time tracking their minerals and ores when they are handed off to manufacturers. What possibilities and challenges emerge for these type of businesses?

Food production

The upside of being a food producer is that people will always need food so they’ll probably have recurring clients and therefore fairly predictable income streams. Food is also an infinite renewable resource if the fields and waters which produce it are managed correctly. Their manufacturing equipment can be leased as a production experience, making the initial investment for a new company significantly smaller. They only need to pay for a production service that fits their scale. This kind of logic applies to every branch of production and gives small scale producers a better chance for survival. As said before, due to the basic income a startup doesn’t need to be profitable, only affordable.

The local, small scale initiatives we already see rising everywhere could get a huge boost from this too, thereby shortening the supply chain, decreasing pollution and making communities more self reliant.

Wood industry

Wood, just as food is an infinitely renewable resource if the forests are managed properly. It’s also a perishable resource, even though some wood types can last for years or even centuries. The more perishable wood types, which usually grow the fastest, would become the basis to build a recurrent client base with.

Clearcutting a forest for quick capital gain obviously wouldn’t be the smartest move when working within a flow economy. Sustainable stewardship of those forests on the other hand can create a regular income that is in sync with the growth rate of the trees.

Solely selling newly produced wood could become a hard thing to do when reuse, repair and recycling get a boost though. But as Gunter Pauli pointed out in his Blue Economy model, stepping away from the ‘one core business’ principle can easily bring in extra money here. Wood recycling can generate an extra income stream, as would tourist activities in those parts of the forest which are not actively being cut.

Mining and fossil fuels

Mining, the oil industry, the gas industry, … they are all inherently unsustainable businesses. It’s all about one time extraction resources and when the reserves are depleted that’s the end of the game. These companies would probably be facing tough times, especially when repairability, reuse and recycling become core values of a successful business model.

If they are future oriented they could get into a very profitable business however: recycling. It would be cost saving for manufacturers to be able to outsource their recycling to specialized sites. Mines, oil fields, gas fields, … these organisations have the space to build these facilities. They could also invest in buying up car graveyards for a boost in their output, thereby freeing up that space for something else. Maybe digging up waste might become one of the most profitable enterprises in an economy of flow.

Science and humanitarian projects, a matter of progress

Right now scientific research has a hard time finding funds unless the science can be turned into something profitable. Humanitarian projects have even a harder time finding funding because you just can’t turn something like eradicating poverty into a multi billion dollar business model. When money is leaking away through a demurrage fee however, people and organisations just might be incentivised to donate their extra money to these causes instead of just having it destroyed by the system. It would mean progress for all of us. Scientific research would flourish and humanitarian organisations would be able to access more and better resources and actually pay their volunteers, creating an extra incentive to work for them.

Lending capital?

In the introduction of new possibilities I talked about the possible abolishment of lending large sums of money. By now you probably see why receiving a couple of million in cash is not so desirable. So what happens when you want to buy a house or a piece of land or take over a business?

The one selling is probably not so interested in receiving the capital all at once unless she wants to buy something expensive with it right away. That’s not always the case though. When someone sells her business there’s a good chance she just wants to retire. Or when a couple sells their house they might want to downsize. In today’s economic system the extra cash would be set aside as a reserve. In an economy of flow that extra cash would just melt away. Not something you want.

Instead of the large sum, the seller is better of to negotiate a monetary flow, something that will keep coming on a, for example, monthly basis for a fixed period of time. Until the entire sum has been paid. Say I sell my 4 bedroom house because I want to go live in a 2 bedroom apartment in the city. Let the house be worth $400 000 and the apartment be worth $250 000 in today’s economy. I’d be way better of to negotiate a $2500 a month flow of money into my account for 160 months than scrambling to put those extra $150 000 somewhere. With the seller of the apartment I’d then negotiate $2000 a month payoff for 125 months, landing me with a surplus income of $500 a month for the first 125 months and a surplus of $2500 for the last 35 months. Not too bad I’d say.

The same could happen for buying businesses and other large investments.

Rich! How rich?

When you can’t get rich from hoarding capital, how do you get rich then? The answer is straightforward: you maximize your income stream. But here’s the catch: if you can’t spend it fast enough your wealth will cap and a lot of money is going to be wasted on demurrage.

This creates a completely different psychological situation from the one we have today. How much can you spend before spending becomes a job on top of the one which creates the income? How motivated are you going to be to get your hands on ever more income generating assets if in the end the income from your latest purchase is completely obliterated due to an ever increasing demurrage fee.

As long as we can get ever increasing returns from our endeavours we are motivated to continue. But with ever diminishing returns that motivation is very likely to drop. Thereby possibly creating a psychological upper bound to wealth hoarding.

Now I haven’t done research on this but if you look at game theory and research on human motivation and behaviour there’s a good chance there might be something here. Anyone up to do some research on it?

Conclusion

Since this kind of economic system hasn’t been implemented yet the conclusions drawn here can not be backed up with experimental data. Existing research on systems, motivation and incentives does provide some solid ground for these assumptions though. If they hold true, then we can create a sustainable, collaborative and caring society without needing a whole bunch of rules and regulations.

My question to you, the reader is the following: please challenge this work. Try to poke holes in it. Where do you see these assumptions challenged? Where do you see them standing strong and why?

This article is based on the monetary system described at Circular Money.

Also published on Medium.

No comment yet, add your voice below!